The money will usually be credited to your savings account within 24-72 hours. You can only execute one RWP per account.

How To Withdraw Redeem Exit Money From Mutual Fund How To Sell Mutual Funds Online Youtube

1 Open-ended schemes these do not come with a lock-in period.

. To start a withdrawal on the app. However two issues need to be kept in mind. For more information on the forms and procedures please contact our Customer Service Hotline at 03-2022 5000.

One there may be an exit load period in certain schemes. Some mutual funds focus on certain types of stocks business sectors parts of the world or stock market indexes such as the Dow Jones industrial average or the SP 500. Under this type you withdraw money from mutual funds partially.

Liquid funds return your money to your bank account within hours. This means that you cannot withdraw money from such schemes before this duration. Money can be taken out of both open ended and liquid funds.

The above-mentioned illustration was an example of partial withdrawal wherein you withdrew Rs 50000 or a small number of units out of the total 10000 units or Rs 1 lakh that was available to you as part of. However you cannot do this until the lock-in period is over. Withdrawing your funds from Public is an easy process.

While Public Apps ACH withdrawal process does cater to most investors anyone looking for wire transfers and checks has a few extra steps to take. Choose the scheme you want to redeem and the number of units. It usually takes T days to complete an open ended task.

Withdrawal proceeds are exempted from the 8 tax penalty. Click on that to bring up a list of your holdings. After completing the process the proceeds from the redemption of mutual funds will be credit directly into your bank account via NEFT within 2-3 working days.

In such cases redemptions before a certain specified period say. Most investment companies or banks with online account access will offer a Trade link next to. Withdrawal can be made monthly bi-monthly quarterly semi-annually or annually.

Scroll down and select the Account Settings Icon. All you need to do is contact your mutual fund agent or any of the central service providers and submit an online redemption request with the AMC through them. A mutual fund pools cash from a large number of people and invests it in a group of stocks bonds or other investments to make up a portfolio.

The PRS Withdrawal Form and supporting documents are to be submitted to any PRS Provider in which the PRS Member has an account with. If you withdraw before a specified period certain funds charge an exit load so read the TnC carefully. Psttt this one for Public Mu.

Cara nak redeem pelaburan unit trust public mutualHere is the video to How you can redeem your unit trust investment via online. Log in to your Mutual Fund account. Select your Profile Icon in the top left corner.

In the case of long-term gains beyond Rs. Just a heads-up that depending on your financial institution it can take up to 5 business days for transfers to and from your bank to settle. The above snapshot is from HDFC Balanced Fund.

You can withdraw money from a mutual fund scheme through a broker or distributor if you invested through them. This means that you redeem a part of the investment while the remainder remains invested. If you look at the mutual fund fact sheet or any mutual fund page on Groww the exit load is clearly specified for each scheme.

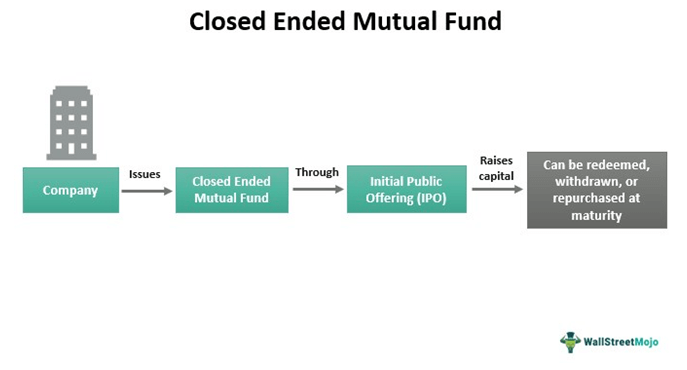

2 Close-ended schemes these carry a lock-in period of 3 to 5 years. The Asset Management Company would receive the form from the broker. To get started with the process you need to get a withdrawal request form if you want to proceed with the.

An investor will have to pay an exit load of 1 if heshe wants to withdraw money before a year. You will be able to withdraw funds from a mutual fund scheme by taking the help of a broker or a distributor especially if you had invested through them. Likewise you can check exit load for all the other funds as well.

Explore the Online Transactions page. RWP is available for cash scheme investments into equity mixed asset balanced bond or money market funds. The type of account you have and.

1 Lakh the tax rate is 10. You must fill out and submit a withdrawal request form if you wish to make a withdrawal offline. You can make contact with your broker and request a withdrawal.

You can get in touch with your broker or distributor and request a withdrawal. Once the redemption is complete funds are transferred to the designated bank account of the investor within 3 business days after the redemption was lodged. Scroll down to Banking and select Withdraw Funds.

For instance with equity-oriented mutual funds if you withdraw your investments within 1 year of purchasing the profits generated will be subject to short-term capital gains tax at 15. In the case of debt funds short-term gains will be added to your annual income and. There is a lock-in period with closed-end funds.

Exit Loads and Applicable Taxes. The broker has a convenient tool to help you from start to finish and you can set up your withdrawal request from both the mobile app and the website. Payout will not be made if the computed RWP withdrawal is below 1000 units.

Addx Academy What Are Hedge Funds Investment Portfolio Investment Loss Risk Management

Mutual Fund Redemption How To Redeem Mutual Funds Online Indmoney

5 Reasons To Avoid New Fund Offers

Nexo Promotion Get A 25 Sign Up Bonus And Referrals In 2022 Bitcoin Account Instant Cash Loans Instant Loans

:max_bytes(150000):strip_icc()/dotdash-money_market_savings-Final-6a3f125ef6c74528ab7be85ce42e468c.jpg)

Money Market Fund Vs Mma Vs Savings Account What S The Difference

Best Tax Free Bonds To Invest In 2020

Mutual Funds Investing Strategy Overview And Advantages

Dcoder How To Use Dcoder App In Telugu Dcoder App Tutorial

19 Equity Mutual Funds Gave 100 Returns In 1 Year Should You Invest Businesstoday

What Is The Strategy To Exit From Mutual Funds Groww

Can We Withdraw Money From Mutual Funds Any Time Is It Without Penalty Tradeveda

When To Exit From Mutual Fund Forbes Advisor India

Investment Articles Loanstreet Financial Literacy Investing Deposit

Closed Ended Mutual Fund Meaning Examples Pros Cons

How Do I Send Money From My Bank To Vanguard Vanguard

See U S News Best Mutual Fund Rankings For More Than 4 500 Mutual Funds Ina Ll Categories Based On Expert Analyst Opinions And F Mutuals Funds Mutual Ranking

Ppf Account Now Deposit More Than Rs 25 000 In Your Ppf Account At Non Post Office Home Branch Savings Account Accounting Public Provident Fund

How To Withdraw Money From Mutual Funds

:max_bytes(150000):strip_icc()/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)